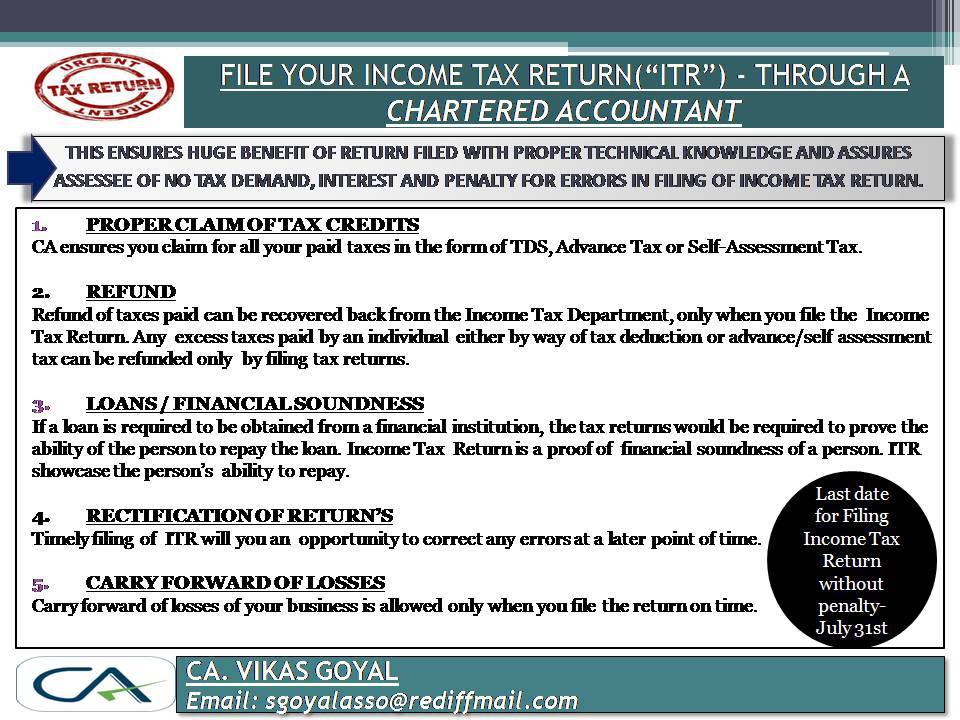

FILE YOUR INCOME TAX RETURN THROUGH A CHARTERED ACCOUNTANT:

Huge benefits for filing your Income Tax Return (ITR) filed with proper technical knowledge and this assures you of following benefits:

- No tax demand, interest and penalty for error in filing of Income Tax Return.

- Proper claims of your tax credits - CA ensures you claim for all your paid taxes in the form of TDS, Advance Tax or Self Assessment Tax.

- Refund - Excess taxes paid by an individual can be refunded only by filing tax returns.

- Loans/Financial Soundness - If a loan is required from banks etc., tax returns would be required to prove the ability of the person to repay loan. ITR is the proof of financial soundness.

- Carry Forward of Losses - Carry forward of losses of your business is allowed if you file your return on time.

LAST DATE OF FILING INCOME LAST RETURNS (Return of income for A.Y. 2014-15):

31st July, 2014 for :-

(I) Salaried employees and other individuals having incomes other than from business, in Form ITR-1 or 2. (II) non-company assessees having business income (not required to get their accounts audited).

AND

30th September, 2014 for:

(I) Assessees required to get their accounts audited u/s 44AB, to obtain Tax-Audit Report.

(II) Non-company assessees having business income and required to get their accounts audited, and working partners of such firms whose accounts are required are to be audited, in Form ITR-3, 4 or 5.

(III) Assessees including compaines claming exemption u/s 11, in Form ITR-7.

"We analyze your tax return for mistakes,

We identify tax deductions you missed,

We show you the results & then e-File. "

|